The ESM: a reliable back-up for the Eurozone or a house of cards risking collapse?

On 27 September 2012 the ESM Treaty came into force, a new addition to the EU’s bailout fund toolbox. This article examines the legal structure of the ESM, considers how it will raise and lend money should a member state request financial assistance and discusses the potential impact for public and private investors in the event of a member state’s insolvency or exit from the EU.

The structure of the ESM

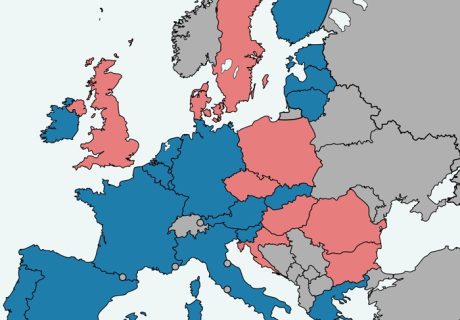

The ESM is an intergovernmental organisation under public international law incorporated in Luxembourg. Its members are the 17 Eurozone member states (ESM Members). It was set up to replace the European Financial Stability Facility (EFSF), which was established in May 2010 as a temporary fund to provide financial assistance (though the two bodies are currently operating in parallel). The ESM has €700bn of authorised capital stock divided into seven million shares. Each ESM Member contributes a percentage based on the European Central Bank contribution key, which reflects a country’s share in the total population and GDP of the EU. Of the total capital, €80bn is paid-in capital with the remainder being callable capital. The paid-in capital is to be paid in instalments, two €16bn instalments having already been paid in 2012. A further two are to be paid in 2013 and the final

€16bn in 2014.

The paid-in capital will not be used for providing financial assistance to troubled member states, but to absorb losses if receiving countries fail to repay. Therefore, to provide funding the ESM will need to issue debt instruments, known in the market as ESM Bonds. An Information Memorandum setting out the terms of the debt instruments to be issued under the ESM’s first debt issuance programme was published on 3 December 2012. It described the governing law of the instruments as “to be determined”, but stated the law to be Luxembourg, English or such other law designated in the relevant Final Terms. Investors will have a close eye on which governing law will prevail, since this will have important implications on which legal regime creditors holding ESM instruments would be subject to, should the instruments be restructured. By way of example, the Greek Parliament was able to modify Greek law and thereby modify the rights of the 86% of the Greek sovereign bondholders whose sovereign bonds are Greek law-governed, facilitating a sovereign debt restructure in March 2012.

The ESM’s issuance is limited by its commitment to keep in place a ratio of paid-in capital to outstanding issuance of 15%. With current paid-in capital it can issue up to €213⅓bn, but should it need to issue more than this before the €80bn is fully paid, the ESM members have agreed to accelerate the payment schedule. The ESM can provide assistance to an ESM Member who requests it through loans, primary and secondary market purchases and eventually, though not currently, through direct bank recapitalisation. The net income generated by the ESM will be placed in a reserve fund, the resources of which will be invested in debt securities (with a minimum AA rating) issued by central banks, sovereigns, Eurozone government related agencies and supranational institutions. Debts of countries borrowing from the ESM will be recorded as due to the ESM itself and not its constituent member states.

The ESM has a board of governors, consisting of ESM Member finance ministers and a board of directors. Under the ESM Treaty, the board of governors is empowered to take the ESM’s crucial decisions. Unanimity is required for it to adopt a decision unless otherwise specifically permitted.

Covering losses

The ESM Treaty incorporates a mechanism to request increased contributions in the event that an ESM Member fails to make the payment under a capital call. Article 25 provides that in that scenario, a revised increased capital call will be made to all ESM Members to ensure sufficient capital is received. The Board of Governors has the power to “decide an appropriate course of action for ensuring that the ESM Member concerned settles its debt to the ESM” within a reasonable period, including charging interest, though, as is discussed further below, the effectiveness of such teeth depends on political capital, not the cost of capital.

If the debt is repaid, the other ESM Members will be reimbursed within 30 days with their contribution to cover the shortfall plus a proportion of the returns made from the default interest payments.

Providing financial assistance

The exact method by which the ESM will provide the financial assistance is likely to be on a case-by-case basis and thus at this early stage it is difficult to draw conclusions as to what legal issues may arise. However, the following points are worth considering. Under recital 13 of the ESM Treaty, the ESM has preferred creditor status meaning that the fund will be paid back

prior to other creditors in the event that an ESM Member that had received assistance subsequently became insolvent. However, in cases of an ESM Member which is already receiving assistance under existing programmes, the ESM will have the same seniority as other loans and obligations of the ESM Member (with only IMF loans being senior).

There has only been one ESM debt issue so far. These were the recently issued bonds for the recapitalisation of the Spanish banking sector. This was an indirect bail-out. In July 2012, financial assistance for Spain of up to €100bn was agreed under the EFSF which on 29 November 2012 was transferred to the ESM.

On 5 December 2012 the ESM issued its first debt securities for a total amount of approximately €39.5bn, consisting of two bills and three floating rate notes. However, the notes were transferred to the Fondo de Reestructuración Ordenada Bancaria (commonly known as the FROB), the Spanish banking bail-out fund, as agent for the Spanish government, which will place the notes with Spanish banks in exchange for preference shares, rather than remaining as ESM Bonds. ESM Bonds are likely to be taken up by a variety of investors, including banks and central banks. A good precedent for ESM Bond appetite can be found in the EFSF’s recent issue of 1.125% 5 year bonds due Oct 2017: its subscribers were made up as follows:

- Central Banks and Government Treasuries: 43%

- Banks: 35%

- Fund Managers: 17%

- Insurance and Pension Funds and other corporates: 5%

ESM Bonds are likely to be an attractive investment on the basis that the ESM may be considered more credit-worthy than some of the Eurozone’s sovereign bond issuers. However, not all rating agencies agree. In November 2012 Moody’s changed the ESM’s long term rating from Aaa to Aa1 on the basis that earlier that month it had downgraded the credit rating of France, the ESM’s second largest contributor.

The impact of an ESM Member’s Insolvency

The ESM’s structure intends to generate investments that can aid struggling ESM Members without exposing investors to the risks of investing directly in sovereign bonds. As long as the ESM Members remain solvent and part of the European Union, the mechanism will perform this function. However, it is worth considering the consequences of an ESM Member’s insolvency and potential exit from the EU and whether this could result in the structure collapsing.

Priority of creditors

Unlike a corporate, a sovereign state cannot enter into formal insolvency proceedings, meaning it is unclear how an ESM Member’s creditors would rank in the event of its bankruptcy. Unless the defaulting debtor has an easily available and valuable asset in a jurisdiction friendly to creditors, the best a creditor can hope for is that negotiations result in some form of bond restructuring (such as the Argentinian restructures of 2005 and 2010 or the Greek 2010 and 2012 bond restructures). However, this will inevitably involve sizeable haircuts for creditors. Such negotiations have also been known to be effected by international treaty (such as the London Agreement on German External Debts which was negotiated in 1953 between the Federal Republic of Germany and North America and the majority of Western Europe). Regardless of whether an ESM Member’s sovereign debt default would be renegotiated, the ESM’s status as a preferred creditor could be controversial as it has essentially granted itself priority over private creditors including sovereign bondholders, affecting their contractual and proprietary rights. This is in contrast to the case of a corporate restructuring, where usually any new cash injection would not have automatic priority but be subject to negotiated conditions.

Furthermore, although ESM bailouts have higher priority than other creditors, in practice it may be difficult to enforce this in the event of an ESM Member’s default and its unilateral exit from the EU. The exiting state could pass its own legislation which prioritised national creditors, or cancel events of default or termination events. This would lead to normal set-off mechanisms in contracts ceasing to apply.

Failure to meet the capital call

If an ESM Member seeking assistance got into further financial difficulty, it would be unlikely to be able to meet its capital call. In this event, if the ESM called upon its members to increase their contribution, these larger contributors could find their share of the burden increasing considerably. This could in turn affect their own sovereign bond yields and they themselves could have difficulty in meeting their own obligations. Moreover, an ESM Member could object to having to increase its contribution if the troubled state then left the EU, as it would not be inconceivable that the debt to the ESM would never be repaid. That state may, reasonably, wish to consider setting-off its own debts to the exiting state against what it considers it is indirectly owed by the exiting state by virtue of that state’s debt to the ESM. This could result in the wheels of the ESM grinding to a halt.

Unlike a corporate or indeed sovereign restructure, in which bonds may contain collective action clauses that could force through a restructuring accepted by a majority of bondholders, if ESM Members began to dissent, it is difficult to see how the Board of Governors could force an increased call for capital. The EU of course has a dispute resolution procedure under Art 258 of the

Treaty of the Functioning of the European Union allowing the European Court of Justice to determine whether a member state has fulfilled its obligations under EU law and order that the member state brings the default to an end or impose a financial penalty. But a financial penalty to a defaulting state is just another debt on its list; hence this is unlikely to have the coercive effect necessary to untangle the defaulting state’s obligations. To illustrate the difficulties that could be encountered, we consider the following scenario:

In 2013, Italy requests €200bn of financial assistance from the ESM. The ESM issues €200bn in bonds inthe primary market due 2018.The following institutions purchase the bonds:

- Italian investment bank A: €120bn

- French investment bank B: €20bn

- Bundesbank: €10bn

- Italian investment bank A has also invested €10bn in French sovereign

bonds. - In 2014, Italian investment bank A and French investment bank B are nationalised by their respective governments.

- The Italian state becomes insolventand defaults on its €200bn obligation to the ESM.

- It also leaves the EU and the ESM and fails to meet its capital calls due in 2014.

- In reaction, the French state, which is owed €20bn by the ESM by virtue of its ownership of French investment bank B, refuses to participate further in the ESM until it receives repayment, including failing to meet the increased capital call.

Set-off

As stated above, the structure of the ESM is constructed to deliberately ring-fence monies raised by the ESM for financial assistance. However, one negative consequence of this, exemplified in the above situation, is that there would be no rights for any parties subscribing to ESM Bonds to set off the amounts owed between them in an insolvency situation.

This is because there is no mutuality of obligations between the defaulting state and an ESM Bondholder as there is no contract between those two parties; the ESM sits in between them. Whilst the Italian state may be able to set off 60% of its €200bn debt to the ESM with the €120bn it is owed by virtue of its ownership of Italian investment bank A, the matter is not as simple with other parties. French investment bank B would be unable to off-set the €20bn it is owed by the ESM against the €10bn that it owes the Italian state under the French sovereign bonds.

Conclusion

For the investor who is not a euro-sceptic, the appeal of an ESM Bond is that it offers exposure to all of the Eurozone countries’ sovereign debt in one instrument with a yield profile similar to that of an average of the Eurozone sovereign yields, weighted by population and GDP makeup. Whilst the scenario we have considered may seem extreme, it indicates that the ESM structure can only protect capital provided by its members whilst each of them remains inside the ESM and the EU.

In the political arena of Europe and the uncertainty that that entails, it is unclear as to whether the ESM will be the preferred tool for any future bailout over, for example, Outright Monetary transactions, a bilateral loan or an IMF programme, but it is at least encouraging that the EU bailout fund’s repertoire has been expanded.

Though the creation of the ESM appears to be a robust move by the Eurozone, critics can argue that it is an all or nothing bet on the permanence of all 17 of its members. Like a house of cards, once one member leaves what remains is in jeopardy.

This article was first published in Butterworths Journal of International Banking and Financial Law.

You can find further information regarding our expertise, experience and team on our Commercial Litigation pages.

If you require assistance from our team please contact us or alternatively request a call back from one of our lawyers by submitting this form.

Media contact: Lydia Buckingham, Senior Marketing Executive, +44 (0) 20 7822 8134, lbuckingham@stewartslaw.com