If you have suffered a life-changing injury and find yourself unable to work, you may be eligible for Universal Credit. Universal Credit is payable to people of working age between 16 and state pension age (currently 65) who are on a low income.

Through our delivery of The Legal Service, a pro bono service offered to patients at a number of NHS trusts over the past 10 years, we have a lot of experience and expertise in helping patients with applications for financial assistance and securing funding for rehabilitation.

Grace Horvath-Franco, a senior paralegal in our Pro Bono team, offers a step by step guide on how to apply for Universal Credit after a serious injury.

How to apply

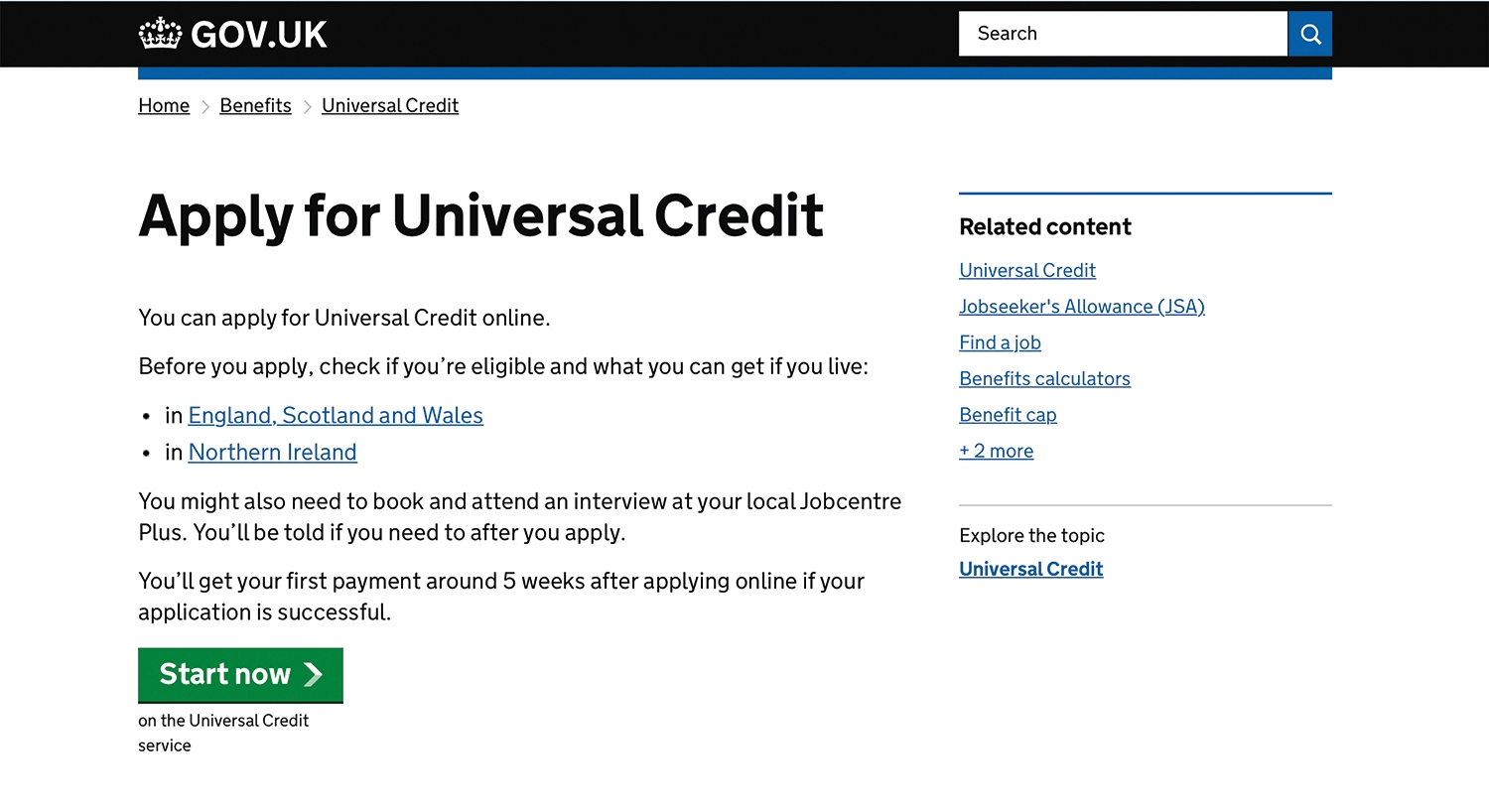

You have to apply for Universal Credit online.

In special circumstances, you might be able to apply by phone. Contact the Universal Credit helpline on 0800 328 5644 to ask if you can apply by phone.}

In special circumstances, you might be able to apply by phone. Contact the Universal Credit helpline on 0800 328 5644 to ask if you can apply by phone.}

Applying online

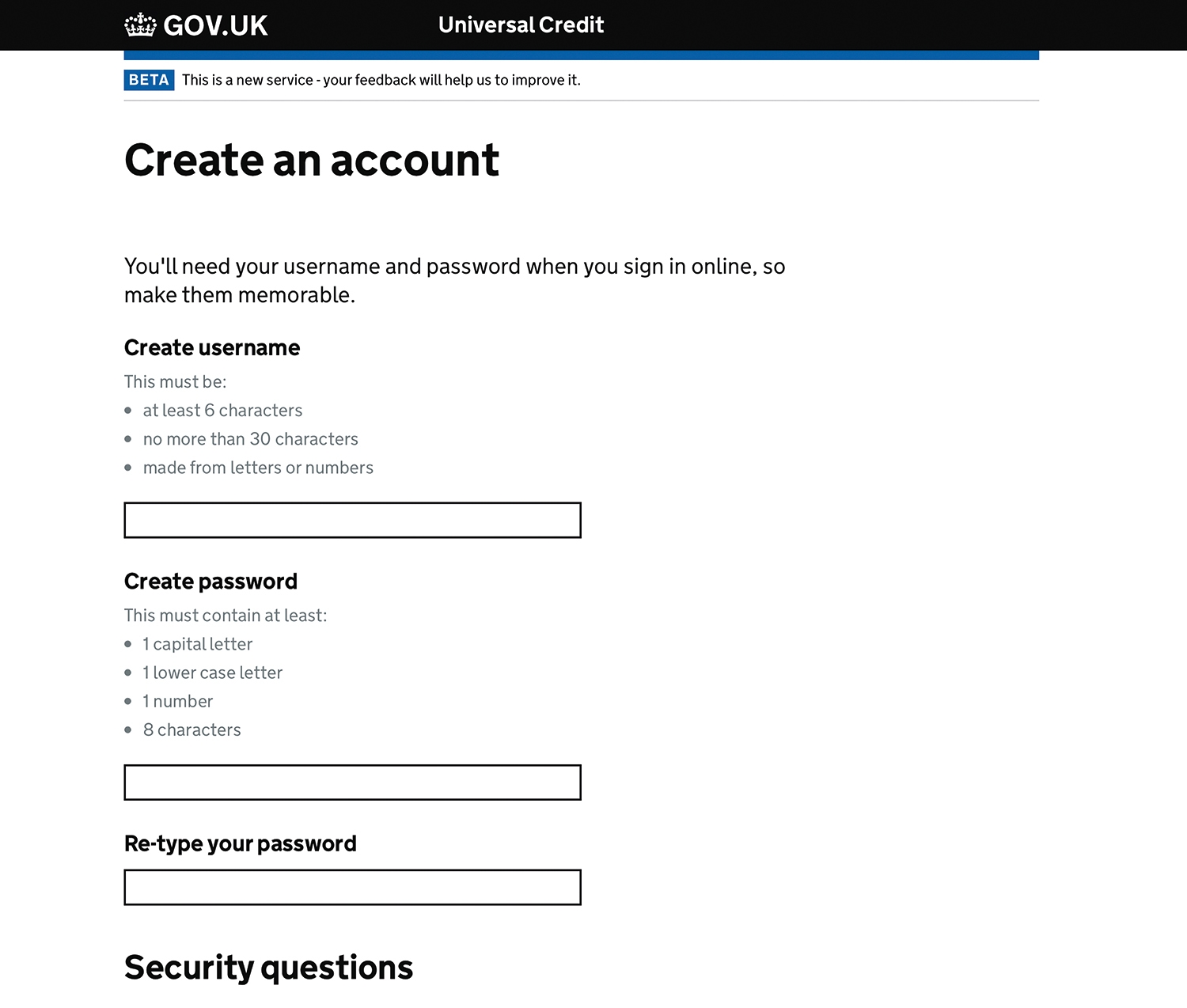

The first thing you need to do is set up an online account. You’ll use this to apply and manage your claim.

You’ll first need to enter your postcode. If you don’t have an address, you can enter the postcode of your nearest Jobcentre.

There are four more steps you need to complete before you can get Universal Credit:

- answer questions about you and your current situation – this is called your ‘to-do list’

- confirm your identity

- make an appointment at your local Jobcentre

- attend your appointment

Covid-19 – you can’t go to a Jobcentre

As a result of the government guidelines, you’ll be able to complete your claim and get a Universal Credit payment without attending a Jobcentre.

1. Completing your ‘to-do list’

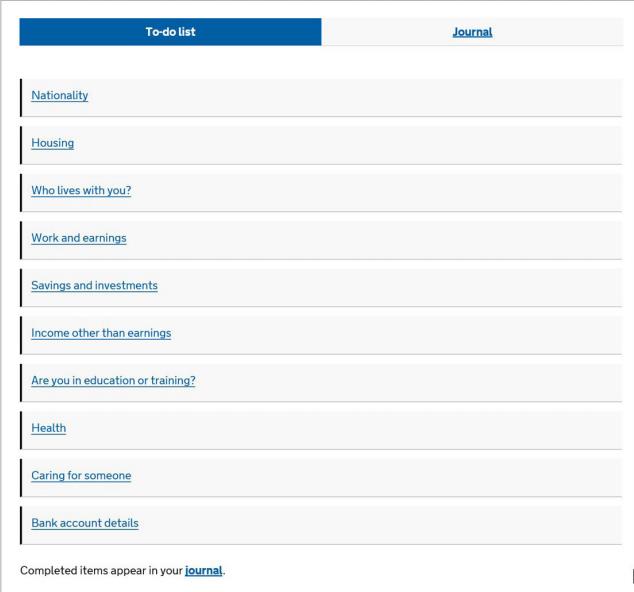

When you log in to your Universal Credit account on GOV.UK, you’ll see a tab called a ‘to-do list’. It consists of different sections you need to complete. You’ll need to answer every question in each section before you can submit your claim.

You don’t have to complete the whole application in one sitting, but it is best to complete your to-do list as soon as you can so that you don’t delay your first payment.

Remember to save your progress as you go. If you don’t do anything for 30 minutes, you’ll be signed out of your account.

The sections in your to-do list

There are different sections in your to-do list with questions on your:

- nationality

- housing situation and who lives with you

- work situation

- income and any savings you have

- education and training

- health

- children and anyone you care for

- bank account

Make sure all the details you enter are correct, and if you’re not sure of something, check any documents or emails you have. If you put in the wrong details, you might be paid the wrong amount or there might be a delay to your payment. If you’re paid too much, you’ll have to pay it back.

When you enter details about any money you pay, you’ll need to be specific and write down how many pennies you paid. For example, if your childcare costs are £100, write down ‘£100.00’.

Once you’ve completed all the questions in a section, you will have to finish all the other sections before you can edit any previous sections.

Your housing

In this section, you’ll be asked for details of:

- your address and when you moved there

- your living situation and if you rent your home

- how much rent you pay and any service charges, or your mortgage payments if you own your home

- how many bedrooms you have – make sure this is the same as the number on your tenancy or rent agreement

- who is on the tenancy agreement and how much you all pay (if it’s a joint tenancy)

- your landlord’s address and phone number if you rent

If you’re not sure about any details, check your tenancy agreement or contact your landlord. Similarly, if you rent from the council or a housing association, you can contact their customer service department for details.

Your ‘housing costs’ and living situation

You’ll need to mention any ‘housing costs’ you pay. This includes any rent or mortgage payments and any ‘service charges’.

A ‘service charge’ is any money you pay for maintenance work in shared spaces around your home or garden. It’s best to check your tenancy agreement to find out if you pay service charges.

If you get any help with your rent, such as Housing Benefit, you’ll need to put down how much your total rent is, including any money you get to help with your rent. For example if you receive £100 of Housing Benefit per month and you pay £300 rent per month, your total rent is £400.

If you rent from the council or a housing association and have any rent-free weeks, you’ll also have to mention those.

The Department of Work and Pensions (DWP) will need your landlord’s details so they can confirm how much rent you pay. If you rent from the council or a housing association, these might appear automatically. If you’re unsure of your landlord’s details, you can enter your own address and update it later. You should remember to update this as soon as possible as you could end up having to pay some money as a penalty if you forget.

You’ll also be asked if your name is on the Council Tax bill and whether you’ve applied for Council Tax Reduction. The DWP can let your council know that you’re applying for Universal Credit if you mention that you already get Council Tax Reduction or you’re planning to apply.

Your health

In this section, you’ll be asked whether you have a ‘disability, illness or ongoing health condition’ that makes it difficult for you to work, or look for work.

You should include any health conditions that have resulted in you taking time of work, including a mental health condition, such as depression or anxiety. You don’t need to include anything that doesn’t affect whether you can work.

You’ll be asked:

- when you last worked, if you don’t work anymore

- if you’ve been in hospital recently

- if you’ve got any medical treatment planned. This is to work out when you can’t attend a Jobcentre appointment

Getting a ‘fit note’

Your GP will need to confirm any health condition that you have listed above with a ‘fit note’ (which you might know as a doctor’s note). You need to provide a fit note if:

- you’re ill for more than seven days

- you have a long-term health condition

If your doctor doesn’t confirm your condition with a fit note, you’ll need to remove the condition from your Universal Credit account.

A fit note will need to have a start and end date, and must be stamped and signed by your doctor.

Covid-19 – if you’re claiming because you have to stay at home due to the government guidelines

You’ll be able to complete your claim and get a payment without a fit note.

If you already have a fit note, you can enter the details straight away.

If you don’t have one yet, you’ll have seven days from the date you submit your claim to get a fit note and put the details into your account.

To get a fit note, make an appointment with your GP as soon as you can. You can also get a fit note at a hospital if you’re being treated there.

You might need to attend a medical assessment if you have a long-term health condition.

After you’ve entered the details of your fit note, you’ll need to put contact details of your GP or medical centre. You’ll be asked if your doctor can be contacted to discuss your health. If you say ‘no’, your first payment may be delayed so it is best to say ‘yes’.

Ensure you keep hold of your fit note as you’ll need to take the paper copy to your Jobcentre interview.

Your work and income

In this section, you’ll be asked if you work or whether you’re self-employed. You’ll be asked further questions about your work situation when you go to your interview at the Jobcentre.

You need to state whether you have any income, which could be from work or other things such as a pension or insurance plan. You don’t need to include any money you receive from welfare benefits.

You need to include any pay you get from your employer for any leave you’ve taken or are taking such as sick pay, holiday pay or maternity pay.

If you’re unsure how much money you get, check your bank statements or contact your employer.

Your savings and investments

You’ll also be asked about savings and other investments you have. For example, you may have shares or own a property that you don’t live in. In this section, you should also include any large one-off payments you’ve received such as redundancy pay.

You wont be able to claim Universal Credit if you have over £16,000 in savings.

Your childcare

It is important to write down any costs you pay for childcare as you can claim up to 85% of your childcare costs if you:

- are working

- have worked in the last two months

- are going to start working in the next two months

You can only claim childcare costs that you have already paid, and you won’t get any money for future costs.

You’ll need to enter the details of your childcare provider and their costs, including:

- their address and phone number

- their registration number

- how much you paid and when

- which dates the payments cover

- which child or children this provider looks after

Evidence of your childcare costs must be given within one month of submitting your claim. It must say ‘paid’ and be on headed paper. Contact your childcare provider if you need any documents.

You can upload this evidence into your online account in the form of a photo, scan or screenshot of your paid invoice. Alternatively, you can take it to your Jobcentre appointment. You won’t be able to receive any money towards childcare costs if you don’t give proof.

After you have completed your ‘to-do list’

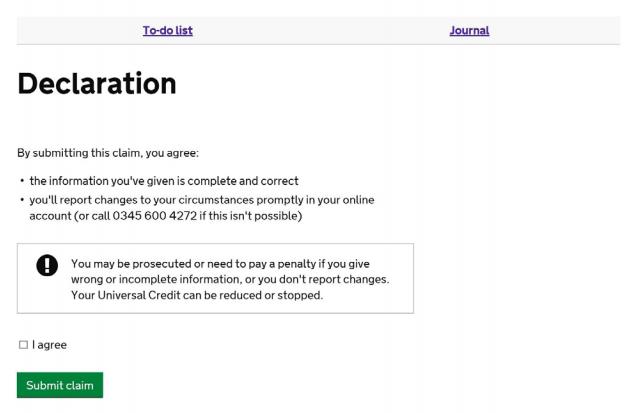

You’ll now need to confirm that all the information you’ve given is correct. Check through everything you’ve written and make sure all the details are correct. Once you’re sure, tick ‘yes’ for each different section. If you tick ‘no’, you’ll be able to update the information before you submit your claim.

You must now complete the declaration and submit your claim.

Depending on your situation you might need to answer extra questions after you’ve submitted your claim.

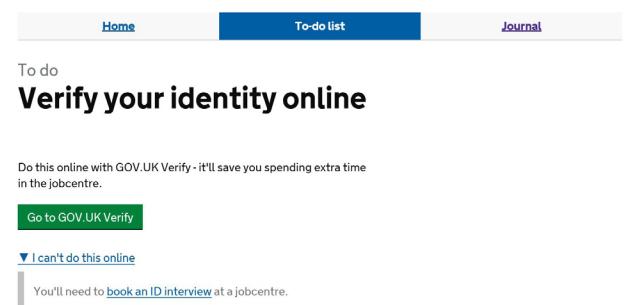

2. Confirming your identity

The next step is to confirm who you are.

If you have certain kinds of photo identification such as a UK passport, a valid UK driving licence or provisional licence, you can use GOV.UK’s online system called ‘Verify’.

If it doesn’t work or you don’t have the right type of identification, you can confirm your identity in person at the Jobcentre. In your account under ‘Verify your identity’ click on ‘I can’t do this online’.

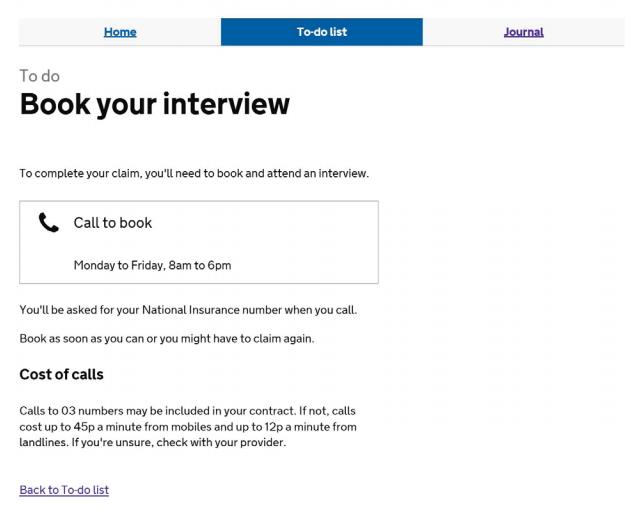

3. Booking an appointment at the Jobcentre

Now you’ll need to book an interview at your local Jobcentre. A link will appear on your to-do list, and you’ll be given a number to call. You’ll need to book it within a week of completing the above. If you don’t arrange the interview within a week, you might have to start your application for Universal Credit all over again.

You’ll need your National Insurance number when you call. You can find your National Insurance number on a payslip or letter from HMRC.

4. Go to your appointment

Covid-19 – interviews

The government has cancelled all face-to-face interviews at Jobcentres. As a result, you currently don’t need to attend a face-to-face interview to claim Universal Credit. Your Jobcentre might ask to talk to you by phone instead.

When you attend your interview, you’ll have to take documents with you that prove you gave the right details in your online application such as your fit note, tenancy agreement and employment contract. You must take any documents you said you’d take with you as well as anything else that helps prove your identity. You won’t get your first Universal Credit payment until you’ve brought all the relevant documents with you.

If you don’t take all your documents, you’ll need to take them to your Jobcentre within one month of your interview. If you don’t, you might have to make a new claim.

After your interview

The DWP aims to make the first payment five weeks after a claim is submitted online.

You can ask for an advance payment of Universal Credit if you don’t think you’ll have enough money to live on while you wait for your first payment. The advance payment is considered an interest-free loan so you’ll have to pay it back.

You must tell the DWP if anything changes in your situation, for example, you get a new job, or you move house. Your Universal Credit might be stopped or reduced if your details aren’t correct. You can make changes through your online account.

This article was written by our Senior Paralegal Grace Horvath-Franco

The Legal Service – We are here to help

The Legal Service, delivered by our pro bono team, provides patients with advice without obligation, for however long it takes to resolve the issue. Our support is available regardless of the circumstances of an accident and regardless of whether a patient has a personal injury claim.

In these difficult times, the concerns of our pro bono clients are likely to be more stark than those in more fortunate circumstances. The Legal Service will be available throughout the crisis to help in any way we can to ease the burden on our clients.

To get advice from The Legal Service, please contact Kara Smith by phone on 020 7822 8000 or by email at ksmith@stewartslaw.com.

You can find further information regarding our injury expertise, experience and team on our Personal Injury pages.

Covid-19 is impacting individuals and companies around the world in an unprecedented way. We have collected insights here to help you navigate the key legal issues you may be facing at this time.

Subscribe – In order to receive our news straight to your inbox, subscribe here. Our newsletters are sent no more than once a month.