Andrew Hauser of the Bank of England has emphasised the need for the cash markets to accelerate the transition away from LIBOR to risk-free rates. This, he said in a speech given on 26 February 2020, is necessary if the target of no new issuance of term LIBOR-linked cash instruments after Q3 2020 is to be met. Mr Hauser’s speech follows announcements from the Financial Conduct Authority (FCA) and Bank of England (BoE) in January regarding the transition away from LIBOR in which they warned firms that the time to act is now. In this article, Harry McGowan, a senior associate in our Securities Litigation team, looks Mr Hauser’s speech.

Mr Hauser acknowledged the challenges faced by firms and said the public sector, in particular the FCA and BoE, had a role to play in providing not only “sticks” but also “carrots”. He announced two new initiatives aimed at supporting the LIBOR transition:

- The BoE is intending to publish a compounded SONIA index from July 2020. It already publishes an overnight SONIA rate and the index will allow market participants to construct compounded SONIA rates in an easy and consistent manner.

- From October this year, the BoE will begin to increase haircuts on LIBOR-linked collateral they lend against, making that collateral less attractive for institutions to hold in comparison to SONIA-linked collateral.

Sonia Compounded Index

The feedback to the BoE from a range of market participants and trade associations was that those participants would prefer a single trusted ‘golden source’ from which compounded rates could be found. The BoE has agreed to publish a daily “Sonia Compounded Index” to provide a simple means of calculating compounded SONIA rates over any given period. The bank has published a paper setting out its proposals.

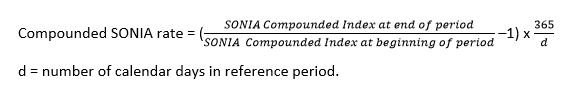

The compounded SONIA rate would only require two rate inputs, namely, the compounded index rate at the beginning and end of the reference period:

The BoE sees three main benefits for market participants:

- Ease – the index will it make easier to calculate compounded SONIA interest rates

- Reduction of uncertainty – the index will use a consistent and standard set of conventions, reducing the scope for confusion over different calculation methodologies (eg what rate do you use for Saturdays and Sundays).

- Flexibility – the index will be publicly available and allow firms and end-users to calculate the compounded rate for products of any combination of start and end dates and any maturity.

Consultation – screen rates for period averages

Some market participants have requested the BoE go further and publish daily screen rates for one or more specific averages, for example, one-month, three-month and six-month compounded SONIA rates. However, the BoE stated that as there are a number of different ways to define the reference period, they would want a clear consensus on the convention to be used. As such, they are opening a consultation on whether there is sufficient consensus from the market on the preferred convention to be used.

Haircuts

As part of its normal lending operations, the BoE provides liquidity support to market participants and lends to firms against a wide set of eligible collateral. However, to protect public funds, the BoE applies a ‘haircut’ to collateral. The current average haircut applied is approximately 25% (eg for collateral with a haircut of 25% against collateral valued at £10m, the BoE would lend £7.5m). To encourage market participants to move away from holding LIBOR-linked collateral the BoE announced two new policies:

- First, from Q3 2020, the BoE will progressively increase the haircuts on LIBOR-linked collateral until the haircut is at 100% at the end of 2021. This effectively means the BoE will not lend against any LIBOR-linked collateral after 2021.

- Second, with the aim of hitting the target of no market issuance of LIBOR-linked collateral post Q3 2020, any LIBOR-linked collateral issued after October 2020 will be ineligible for the BoE lending facilities.

The BoE believes this is a manageable time-frame for firms to transition from LIBOR-linked collateral to risk-free rate alternatives.

Litigation risk

With regards to litigation risk, if the publication of the SONIA Compounded Index facilities a speedier cash market transition from LIBOR-linked product to SONIA, then that should reduce the volume of LIBOR-linked products in existence on cessation of LIBOR, thereby reducing litigation risk. However, it does not address how legacy LIBOR-linked collateral should be transitioned to SONIA.

To transition a spread, adjustment is required to compensate for the difference in value between LIBOR and SONIA, and this would need to be agreed along with a mechanism to agree the amendments to the documentation. There is no industry agreed procedure to amend legacy loan facilities and the documentation for the bond market varies for individual issues. Therefore, there is still a risk that a significant volume of LIBOR-linked legacy cash product will be in circulation upon cessation of LIBOR. Inevitably, that is likely to lead to disputes on how the rates post-cessation of LIBOR should be calculated.

You can see a full list of our current securities litigation cases and investigations here.

You can find further information regarding our expertise, experience and team on our Securities Litigation pages.

If you require assistance from our team, please contact us or alternatively request a call back from one of our lawyers by submitting this form.

Subscribe – In order to receive our news straight to your inbox, subscribe here. Our newsletters are sent no more than once a month.