The construction sector has been subject to a significant liability shift following a wholesale review of building regulation and practice after the Grenfell Tower fire in June 2017.

The Building Safety Act 2022 (“BSA”) has altered the landscape, and the changes in the law introduced have given rise to an influx of disputes. Historical defect claims previously time-barred have been brought back to life by renewed limitation periods. Additionally, several new duties and liabilities have been introduced, alongside a handful of groundbreaking remedies that have the potential to give rise to significant financial orders, including on a non-fault basis.

Against that backdrop, construction disputes, particularly those on issues of building safety, remain firmly at the forefront and show no signs of slowing down. Concurrently, such a seismic shift in duties, liabilities and remedies has an equivalent impact on the potential for coverage disputes, particularly in areas of unchartered territory.

Unfortunately, more than seven years on from the Grenfell Tower tragedy, unsafe cladding remains on thousands of high-rise and tall buildings across England.

The sheer scale of the remediation works still to be undertaken across England is evident from the government’s 85th data release on building safety remediation.

As at 30 November 2024:

- Of the 4,998 “tall” residential buildings (11 meters and over in height) that require remediation works for unsafe cladding, only 48% of buildings have completed or are undertaking remediation works, with 2,601 tall buildings yet to be remediated, and

- Of the 514 “high-rise” residential and publicly owned buildings (18 metres and over in height) that have aluminium composite material (“ACM”) cladding systems, 22 buildings are yet to start remediation works, and

- Of the 809 high-rise residential buildings with unsafe non-ACM cladding eligible for funding from the Building Safety Fund (“BSF”), 288 buildings are yet to start remediation works9.

The headline is that thousands of affected buildings and leaseholders are still awaiting remediation works, which will take many more years to complete. That is without even factoring in the 4,000 to 7,000 buildings across England that the government estimates have unsafe cladding but are yet to be identified.

On 2 December 2024, in an effort to address the delays (the reasons for which are numerous), the government published its “Remediation Acceleration Plan”. The upshot of the plan is that by the end of 2029, the government expects all high-rise (18m+) buildings with unsafe cladding falling within a government-funded scheme to have been remediated, and every tall building (11m+) with unsafe cladding to have either been remediated or have a date for completion, with landlords placed under threat of “severe penalties” if they do not comply.

The latest announcement will be welcome news to the thousands of leaseholders living in limbo in potentially unsafe developments that may be impossible to sell. Indeed, there are an estimated 66,000 residential dwellings in just the 809 high-rise buildings that are eligible for funding in the BSF with non-ACM cladding.

What many leaseholders do not see, however, is the involvement of insurers behind the scenes who agreed to provide professional indemnity (PI) insurance to developers, architects, engineers and contractors for such risks. Insurers are now seeking to avoid coverage for the significant liabilities arising.

Indeed, we have witnessed insurers across the London market adopt differing approaches to coverage, particularly on notification, aggregation, the scope of exclusions and any non-insured losses apportionment. Additionally, while fire safety claims have often been notified many years ago, we have seen multiple insurers delay setting out any position on coverage until a matter of weeks before the policyholder is required to make remediation payments. In such circumstances, there is no doubt that disputes over insurance coverage of remediation works are contributing to the ongoing delay in completing or even commencing work.

Coverage disputes are becoming more commonplace across the construction market. Policyholders facing claims (notified under any professional indemnity, contractors’ all risk (“CAR”), product liability and/or directors’ and officers’ policy) should carefully consider their policy wording and any arguments raised to extinguish or reduce cover.

Cladding and fire safety claims

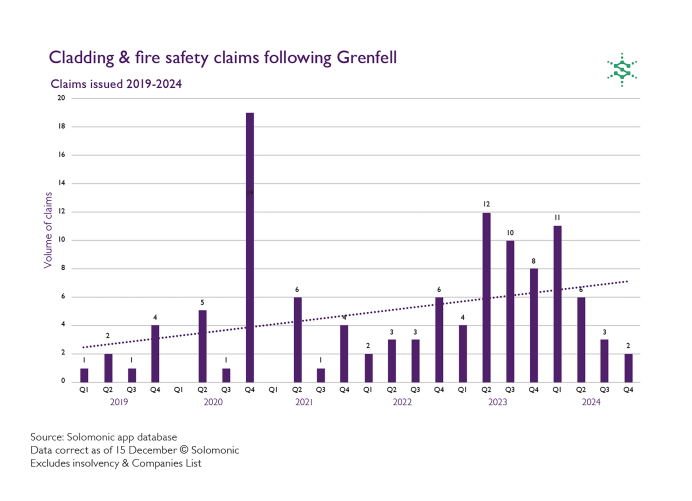

Following the Grenfell Tower fire, the number of claims issued in the Technology and Construction Court (the “TCC”) relating to cladding or defective buildings and fire safety continues to increase.

Since 2019, there have been 114 such claims issued in the TCC, with total specified claim values exceeding £640m. Notably, the number of claims issued per year peaked in 2023, no doubt due to the introduction of the BSA.

Looking forward, although 2024 saw fewer claims issued in the TCC, the BSA has led to parties seeking new remedies in the Property Chamber of the First-tier Tribunal (the “FTT”), which are not available in the TCC. Therefore, it is possible that we may see an influx of claims returning to the TCC for determination in due course when disputes arise as to which party should ultimately bear the costs of any Remediation Orders made.

Read more

This article is an extract from The Policyholder Review 2024/25. A detailed review and commentary on the key developments and trends across various commercial lines of insurance.