On 24 September 2024, the Government Actuary completed her review and determination of the personal injury discount rate (PIDR) in Scotland and Northern Ireland, respectively, setting the rate in both jurisdictions at +0.5% with effect from 27 September 2024.

Some key aspects of this had been foreshadowed by policy notes issued in April 2024 by the Justice Department of the Scottish Government and the Department of Justice of Northern Ireland. One of these was that with the phasing out of RPI, it was necessary to find a suitable alternative inflation index measure.

Writing for the 1 November edition of New Law Journal, Stewarts partner and FOCIS chair Julian Chamberlayne and co-authors Professor Victoria Wass (Emerita Professor of Labour Economics, Cardiff Business School) and Chris Daykin (Independent Consultant and Actuary) queried the basis of the calculation of the personal injury discount rate in Scotland and Northern Ireland.

Reflecting on submissions

The legislation in both these jurisdictions provides that a single unadjusted published index must be used to represent inflation when reviewing the discount rate. Both governments reflected on submissions made in response to the preceding calls for evidence, observing that stakeholders representing claimants generally contended that most future losses are subject to earnings inflation. In contrast, respondents representing defendants argued that economic conditions in recent years suggested that damages would inflate at a lower differential to prices than had previously assumed. Both governments concluded that the most suitable published measure available was average weekly earnings (AWE).

The policy note from the Scottish Government explained: “Compared to a prices based measure, an earnings measure better reflects inflation in relation to loss of earnings and care costs (including nursing) – both of which are likely to be associated with awards of future pecuniary loss to which the discount rate is relevant. An unadjusted prices index – such as the consumer prices index (CPI) – is likely to undercompensate. AWE is preferred over other earnings measures because it is considered to be more appropriate for projecting future rates of change and provides a continuous measure.”

The adoption of AWE was subsequently ratified by statutory instruments passed on 1 July 2024 in both jurisdictions.

Crunching the numbers

For both Scotland and Northern Ireland, the Government Actuary is the ‘rate setter’ and has to work within parameters laid down in legislation. One of the main factors the Government Actuary needed to determine was the long-term differential between the average weekly earnings (AWE) index and the consumer prices index (CPI) as a key component to setting the new PIDR in both jurisdictions. At paragraph 3.10 of her reports for both jurisdictions, she explained:

“I have assumed that AWE will increase in line with CPI + 1.25% pa. I have considered

long-term historical rates of real earnings growth (since 1970s) and allowed for lower

levels in more recent years. I have also considered other sources of information for this

assumption such as the Office for Budgetary Responsibility’s (OBR) assumptions and

other views on earnings provided to GAD [the Government Actuary’s Department] directly.”

She further explained this determination in Appendix B as follows:

“B11. Given the investment period is 43 years, I have considered the future outlook for AWE

from a number of sources, alongside the historical long-term average rate of increase

relative to CPI.

“B12. The Office for Budgetary Responsibility (OBR) produces assumptions around earnings

over the long term. The OBR’s medium-term forecast for average earnings inflation which

ranges from CPI – 0.5% pa to CPI + 1.4% pa over periods to 2028. The OBR’s longer-term outlook has earnings stabilising at CPI + 1.8% pa from 2036.

“B13. I have also considered information from academic and other sources on general future

earnings inflation. These sources suggest a rate anywhere between CPI + 1.25% to CPI +

2% could be justified.

“B14. Therefore, my assumption of CPI + 1.25% for AWE has been set taking into account the

longer- and shorter-term historical rates of earnings inflation relative to CPI and a range of

forecasts of future earnings inflation.”

On its face, this seems a surprising determination and has prompted the Forum of Complex Injury Solicitors (FOCIS) and the Association of Personal Injury Lawyers (APIL) to make a joint Freedom of Information Act (FOI) request for the unparticularised sources the Government Actuary relied upon. They query the basis on which she was able to reasonably make this determination for the long-term (assumed 43-year average period of loss) at a materially lower rate than the closest matching long-term projection of the OBR.

It is notable that in the 2019 Government Actuary’s Department (GAD) report for England and Wales, the then Government Actuary said: “My assumption that earnings will exceed CPI by 2% pa is therefore intended to be a neutral assumption over the long-term”. There was no equivalent section in the GAD reports for Scotland and Northern Ireland because their legislation prescribed the use of RPI. That begs the question of why, after just five years (that were anomalous in inflationary terms), the current Government Actuary feels able to determine the long-term earnings inflation differential at 0.76 percentage points (PP) lower than GAD’s Table B1 estimated as the historical differential (as in their and 0.55PP lower than OBR’s long-term projection.

Recent GAD reports that have considered the likely long-term earnings inflation differential include the GAD review of the National Insurance Fund, published on 17 March 2022. Future earnings and prices assumptions are as follows: CPI 2% pa throughout, earnings 3.7% for 2027-2035 and 3.8% for 2036-2085, namely 1.7% and 1.8% pa real earnings growth.

More recently, GAD has published reports on the actuarial valuations of the NHS and teachers’ pension schemes, using economic assumptions set by the Treasury. In both reports, published in April 2024, CPI is assumed to increase at 2% pa and earnings at 3.8% pa for the long term (ie 2028/20 onwards), namely a real earnings increase of 1.8% pa. This is also more in line with co-author Chris Daykin’s experience of what actuaries generally assume for future real earnings growth and is in addition to assumed salary progression for individuals.

The above determinations are all consistent with the OBR’s long-term projection, which begs the question: what evidence was used by the Government Actuary to prompt this large step change downwards? If her determination of this aspect were correct, it would have significant economic ramifications for many governmental departments. Consequently, FOCIS and APIL also requested clarification of whether she consulted with the OBR, Treasury and/or Bank of England and, if so, whether they endorsed her assessment.

England and Wales

The legislative framework for the forthcoming determination of the PIDR in England and Wales is different as it allows the use of an adjusted inflationary index. In the 2019 determination, that was CPI +1 PP, based on a broad-brush estimation of a 50/50 split of future losses between those predominantly subject to earnings (as above, then assumed by the Government Actuary to be +2 PP) or prices (CPI) inflation.

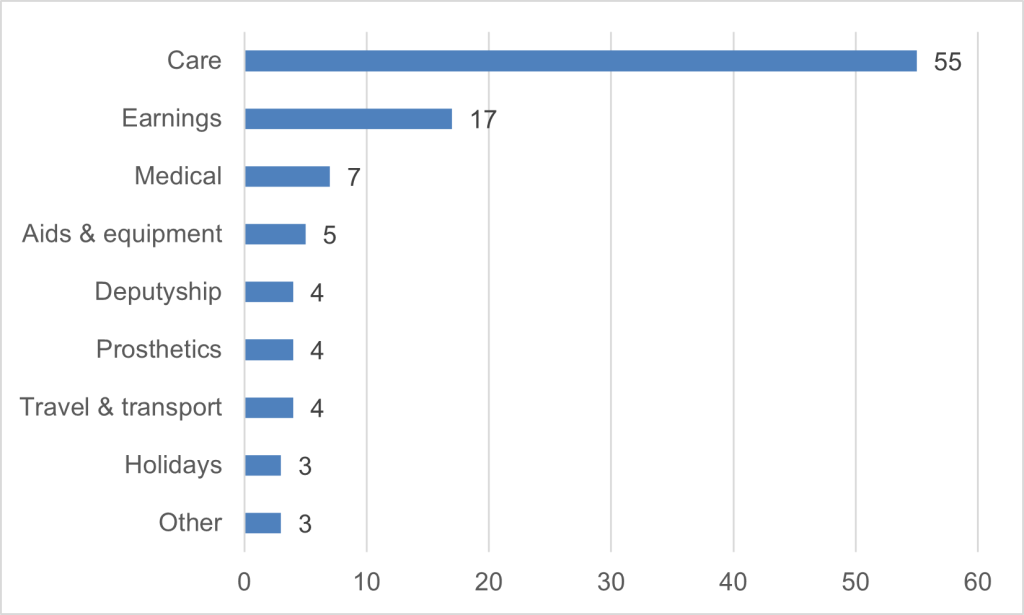

The Ministry of Justice’s (MOJ’s) call for evidence that closed in April 2024 sought evidence on this split of future losses to better inform the inflationary component of the forthcoming PIDR determination. In the short period allowed for that call for evidence, FOCIS and APIL gathered and analysed data from nine firms with a cohort of 114 cases. They contended that following the Swift v Carpenter decision, the calculation of the cost of purchasing and adapting accommodation to meet disability-related needs no longer uses the PIDR. Figure 1 shows damages to be top heavy in earnings-related heads: with 83% of the residual heads of loss related to earnings inflation (care and case management, earnings, medical treatment and therapies and deputyship costs).

Figure 1 Allocation of heads of loss (without accommodation) %

Focusing on the largest head of loss, care claims, co-author Professor Victoria Wass’s submission to question 8 of the MOJ’s call for evidence said: “My recommendation for current care cost inflation is at CPI+1.7PP, rising to CPI+2.0PP for future care cost inflation.”

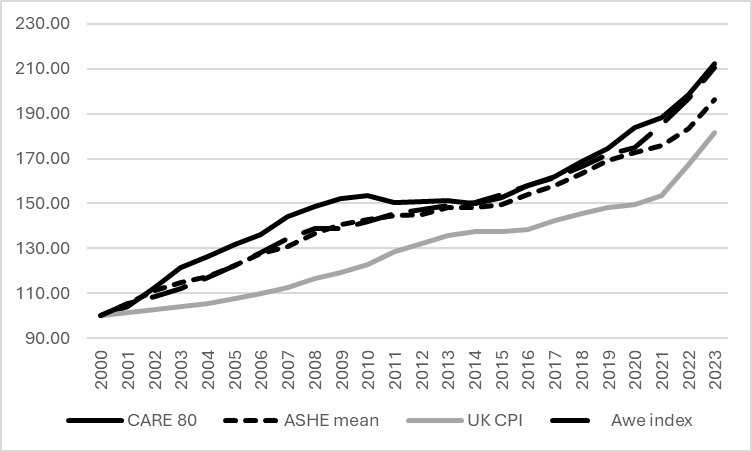

The use of the AWE CPI differential is designed to capture a broad indicator of real wage growth. Collection of AWE began in 2010 with backcasting to 2000 based on its predecessor measure the Average Earnings Index. It is published monthly and is the lead indicator of short term changes in earnings. For readers more familiar with the Annual Survey of Hours and Earnings (ASHE), AWE has tracked ASHE mean though at a slightly higher rate from 2019 (see Figure 2).

Figure 2 compares the evolution of AWE, CPI and ASHE mean with ASHE 6115 at the 80th for the period over which all four are available (2000 to 2023) but which is shorter than the assumed 43 years duration of the award.

Averaging across time is highly sensitive to the time period chosen. This is clear from GAD’s Table B1, where average above-CPI earnings growth from 1971 to 2024 is 2.1% pa and from 2010 is 0.1% pa. Care wage inflation exceeds CPI inflation by between 0.7PP (2015-2023) and 1.7PP (2015-2021). The latter is a preferred estimate since the impact of the cost-of-living crisis on real wages will likely work itself through over the next couple of years and is consistent with the OBR long-term assumption for real earnings growth at 1.8PP.

To the extent that the Government Actuary and Lord Chancellor are interested in care cost inflation, this is likely to continue to be above aggregate wage inflation. Population ageing and the increasing competition for recruiting carers, particularly following Brexit, will continue to fuel care wage inflation. One might have thought that the increases being assumed for earnings in the NHS in the GAD’s above mentioned recent NHS pension review might also have some bearing on carers’ earnings growth.

Conclusion

The Government Actuary’s recent assumption that the long term projected difference between CPI inflation and AWE inflation is just 1.25PP represents a step change downwards from the long term projection used in the determination of the PIDR in England and Wales in 2019 (2.0PP), the most recent OBR projection in 2022 (1.8PP) and GAD’s own assumptions (1.8PP) used in its valuations of the NHS and Teachers Pension Funds and the National Insurance Fund as recently as April 2024.

For transparent decision-making on such an important topic, any evidence that might justify a departure from the OBR predictions should be identified. We therefore eagerly await the Government Actuary’s response to the FOCIS and APIL FOI request. The MOJ has also been asked to pass the FOCIS/APIL observations on to the expert panel advising the Lord Chancellor on her forthcoming determination.

Due to the restriction in the Scottish and Northern Irish legislation to only use an unadjusted index, the Government Actuary had the choice of recommending CPI, which would give no weight to real earnings growth, or AWE. This means essentially assuming all damages go up in line with earnings. As the vast majority of future losses for seriously injured claimants are impacted by earnings inflation, AWE provides a fair outcome for claimants in those jurisdictions, but only if the differential between it and CPI is set at a reasonable level for the assumed 43-year average period of future losses.

The 0.55 PP differential between the OBR’s long-term projection for earnings inflation and the Government Actuary’s PIDR determination for Scotland and Northern Ireland would make a considerable difference to claimants with long-term disabling injuries. If, as the authors contend, she has materially underestimated the long-term earnings inflation differential, that will likely result in many of the most seriously injured claimants running out of funds to meet their high-level care needs in their later years. Not only will that be disastrous for them and their families, but it will also likely increase the incidence of such claimants falling back on the state to meet their care needs, at a significant cost to tax-payers.

You can find further information regarding our expertise, experience and team on our Personal Injury and Clinical Negligence pages.

If you require assistance from our team, please contact us.

Subscribe – In order to receive our news straight to your inbox, subscribe here. Our newsletters are sent no more than once a month.