(read time: < 3 mins)

Stephen Foster recently featured in the latest Spear’s 500 guide to the top private client advisors, giving the latest legal position of the ‘special contribution’ argument. Full article below.

Stephen Foster of HNW divorce specialist Stewarts gives us the latest in the legal position of the ‘special contribution’ argument.

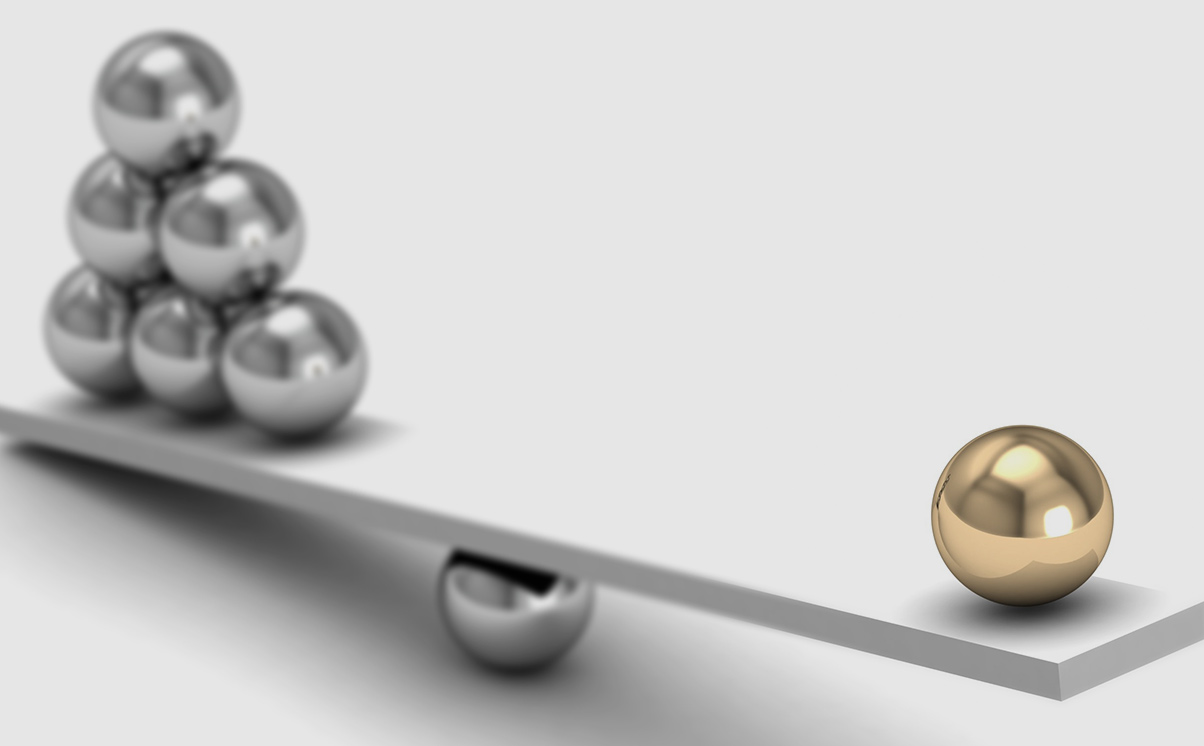

Since the landmark House of Lords case of White V White (2000), which established for the first time that an applicant’s needs in ‘big-money cases’ should not be the determinative factor, wealthy individuals have endeavoured to find legitimate reasons to persuade judges to depart from equality. Consequently, it has become common for high-fliers to argue that their contribution to the marriage was ‘special. Special contribution has, in fact, only been argued successfully by an elite few. It was pioneered by a bin liner entrepreneur who persuaded the court in 2001 that his contribution to the family finances was so exceptional that he should receive 62% of the assets. In 2006, Martin Sorrell claimed successfully that it would be unfair to ignore his ‘genius’ as the generator of the family fortune through WPP, his media company, and was awarded 60% of the £100 million marital pot. In Charman v Charman (2007), the court took into account the husband’s ‘remarkable’ abilities in the insurance world; he retained 63.5% of the assets. In Cooper-Hohn v Hohn (2014), a hedge fund manager was awarded 64% of the marital pot of US$1.5 billion.

Set against these, there has been a long succession of cases in which special contribution arguments have fallen short. In 2017 the American financier Randy Work failed to convince the Court of Appeal that he should be given credit for his ‘genius’ as an investor. Similarly, a High Court judge rejected a 61-year-old Russian billionaire’s argument that he made a ‘special or stellar contribution’ to the creation of the couple’s £1 billion fortune, the judge finding that his contribution was ‘unmatched’ because while he was away in Russia, building up the business, his wife was ‘keeping the home fires burning’. However, later that year in XW v XH, The court found that the husband’s role in growing the value of the business assets which justified a departure from the equal sharing principle. This demonstrated that the concept of special contribution, although rarely successful, remains alive and kicking.

Special contribution has only been run successfully by husbands, and many in the legal profession consider it an outmoded concept. Many couples agree that the husband will be the breadwinner while the wife will run the home and raise the children, each in their different spheres contributing equally to the family. The question is: can special contribution be only financial? If so, does it not follow that the concept is discriminatory? The difficulty for stay-at-home wives (or husbands) is there is no equivalent way for them to demonstrate the extent of their contribution. In that context, it is perhaps timely that, in the centennial year of the Representation of the People Act 1918, the wife in XW v XH, for whom Debbie Chism and Richard Hogwood of this firm act, has recently been given permission to appeal. The outcome of that appeal is likely to have a far-reaching impact on how these cases are dealt with in the future. Watch this space.

You can find further information regarding our expertise, experience and team on our Divorce and Family pages.

If you require assistance from our team, please contact us or alternatively request a call back from one of our lawyers by submitting this form.

Subscribe – In order to receive our news straight to your inbox, subscribe here. Our newsletters are sent no more than once a month.