Stewarts and Solomonic have worked together to produce and analyse data regarding commercial fraud claims in the civil courts of England and Wales. The findings indicate that the volume of fraud claims has risen since 2014, they are most commonly issued in the Commercial Court and they are more likely to succeed than negligence or general tort claims.

In these extracts from the report, Alex Jay explores the general rise in the number of fraud claims issued and judgments given; Mo Bhaskaran considers the “dominance” of the Commercial Court as the arena for such claims; and Elaina Bailes compares the relatively high success rate for fraud claims with other types of claims.

Volume of claims

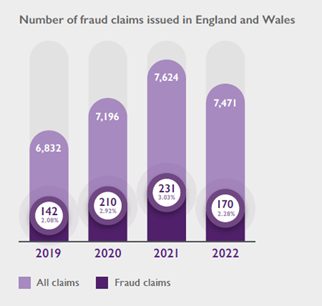

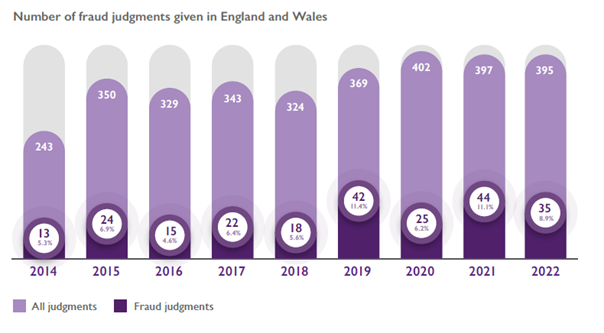

The number of claims issued and judgments given involving issues of fraud has generally increased in recent years, although there was a reduction in claims issued in 2022 and there has been a plateau in judgments since 2019.

The data shows that fraud is a constant feature of commercial litigation in the English courts. Cases involving those issues hover at c.2-3% of claims issued since 2019 and c.5- 11% of judgments given since 2014. That is in and of itself significant: it is reflective of the experience the English courts have of dealing with these types of issues, the remedies available under English law and procedures and, more fundamentally, the inevitable darker hinterland of commercial dealing in the UK in the context of the economic pressures of the last decade.

The data also indicates an upward trend in the number of fraud claims since 2014, both as standalone figures and proportionally in the context of other types of claims. This would most obviously be indicative of an increase in fraudulent behaviour. However, other factors could be at play, such as a heightened awareness of and willingness to plead fraud causes of action.

There was a notable (c.26%) reduction in fraud claims in 2022, over and above the wider reduction in all claims issued and judgments given in that period. It is too early to tell if that is a wider trend or the extent to which issues such as Brexit are having an impact, not least given that the figures show a relatively high degree of year-on-year fluctuation. Indeed, we would expect the current economic climate to produce more claims in this area, potentially in combination with claims arising from the distribution of funds to support businesses through COVID-19. What is clear is that commercial fraud will remain a significant part of the work of the English courts.

Preferred courts

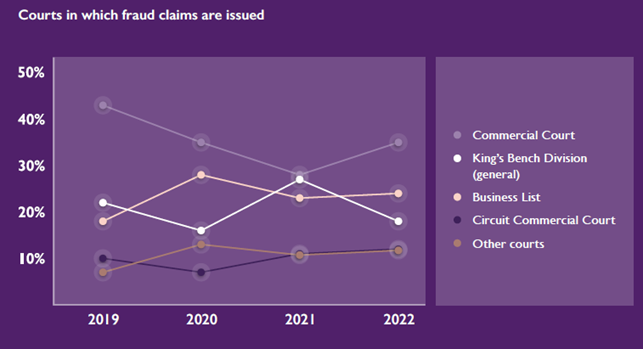

The Commercial Court has been the clear court of choice for issuing fraud claims since 2019, followed by the Business List (by far the most significant Chancery Division representative), the general Kings Bench Division and the Circuit Commercial Court.

The Commercial Court’s overall dominance indicates the value of the fraud claims being issued, ie that they are higher value and likely more complex. However, it also reflects the fact that it is particularly well suited to these types of claims, including due to its experience in considering these types of issues, its familiarity with granting injunctive relief such as worldwide freezing orders or search orders and the internationality of its users (which we touch on elsewhere in this report).

The Commercial Court’s own data states that 5% of all claims issued in that court in 2021-22 were commercial fraud claims and 4% were pre-action injunctions. It also states that 4.48% of claims issued in the London Circuit Commercial Court were commercial fraud claims. This emphasises the familiarity of those courts with these types of claims.

The data indicates the potential start of a slight downward trend in the Commercial Court’s share since 2019. This (along with the slight increase in claims in the general King’s Bench Division, Circuit Commercial Court and other courts) potentially indicates an increase in lower value or less complex disputes. However, for all the reasons given above, we see that the Commercial Court is likely to remain the court of choice for general fraud disputes for the foreseeable future.

Success rates

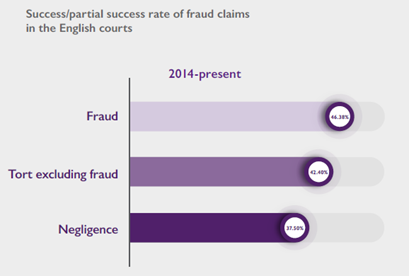

Where fraud claims have reached the judgment stage since 2014, they have had a c.50% success rate, which is higher than other tort claims and significantly higher than negligence claims.

The data indicates that, since 2014, where fraud claims have reached the judgment stage, they have a roughly equal success and failure rate. In and of itself, this outcome is not surprising. On the one hand, fraud or dishonesty can only be pleaded where there is credible material to support the allegations made and the particulars need to be carefully and distinctly set out, which means that fraud claims need to be carefully prepared. On the other, those exacting requirements mean the courts will subject those claims to particular scrutiny. Overall, these two factors weigh finely in the balance. Some of those principles were recently examined and restated by Mr Justice Bryan in National Bank Trust v Ilya Yurov & Ors [2020] EWHC 100 (Comm).

However, more interestingly, fraud claims are slightly more likely to succeed than other tort claims and significantly more likely to succeed than negligence claims (which have a 62.5% failure rate). This may again be indicative of how those cases are pleaded or which of those cases settle and which reach trial. The high bar for proving allegations of fraud means that cases are not likely to proceed to judgment unless the prospects of success are good. At any rate, it should give potential claimants confidence that the English courts are willing and able to assess fraud issues and make findings of fraud, where appropriate.

You can find further information regarding our expertise, experience and team on our Fraud pages.

If you require assistance from our team, please contact us.

Subscribe – In order to receive our news straight to your inbox, subscribe here. Our newsletters are sent no more than once a month.