Stewarts and Solomonic have again worked together to produce and analyse data regarding commercial fraud claims in the civil courts of England and Wales. This second ‘Analysing trends’ report reviews how the volume of claims, preferred courts and sector coverage have developed since our first publication in 2023. The data shows the continued strength of fraud disputes in the English courts.

Stewarts partners Alex Jay, Mo Bhaskaran and Pia Mithani and senior associate Charlie Mercer examine the most striking trends and recent developments in civil fraud. This year’s report also considers views from Germany, the USA, India, Singapore, the Cayman Islands and the Middle East on why the English courts remain popular for parties from these jurisdictions.

Read the Analysing trends 2025: Data from commercial fraud claims in England and Wales report

Analysing trends 2025: Data from commercial fraud claims in England and Wales report summary

Our latest available data shows the continuing popularity of the English courts with litigants from other jurisdictions. We have, therefore, focused this year on why the English courts have that international appeal. We are grateful to our esteemed colleagues for their insights into key overseas markets:

- Wolfgang Sturm and Jonas Kiehl at Broich

- Gonzalo Zeballos and Oren J. Warshavsky at BakerHostetler

- Danny Ong at Setia Law

- Nick Hoffman at Harneys

- Keith Hutchison at Clyde & Co

Sherina Petit, Head of the India and International Arbitration practices at Stewarts, provides an Indian perspective.

English practitioners have long had a sense of the UK as being a preeminent jurisdiction for fraud claims and offering a number of benefits, be that the brutal effectiveness of worldwide freezing orders and search orders, the sophistication of our judges or the broad disclosure regime. Our conversations have stress-tested this. Some of the reflections were expected, such as the importance of underlying commercial ties, faith in a robust legal process and the availability of worldwide freezing orders and other interim relief. Others were less expected, such as confusion about the solicitor/barrister distinction, challenges from other fora (including the Dubai International Financial Centre and Singapore) and a likely increase of Indian parties given increasing commercial ties.

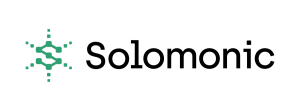

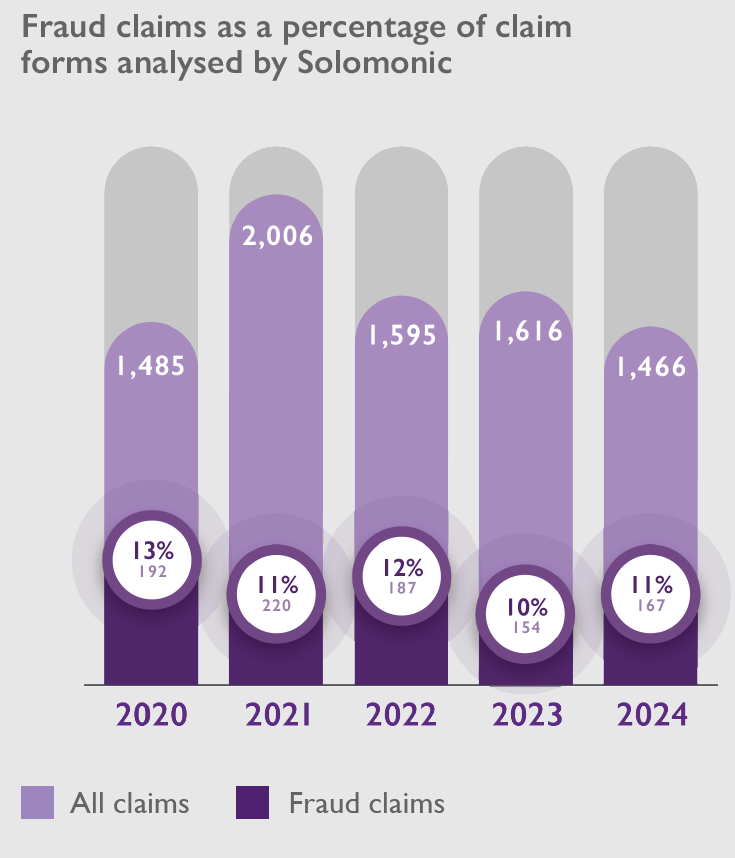

The analysis in this report has been based on data provided by Solomonic, the litigation analytics platform. Solomonic analyses claim form, judgment and other data from claims in the UK. It is an invaluable resource for researching, analysing and understanding the UK litigation market.

Current trends in fraud litigation

- Volume: The number of fraud claims and judgments has remained relatively consistent since at least 2020, albeit there was a slight uplift in claims issued in 2024.

- Preferred courts: The Commercial Court has lost its supremacy, with the general King’s Bench Division now being the most popular for issuing claims.

- Sectors: Banking and finance claims remain dominant.

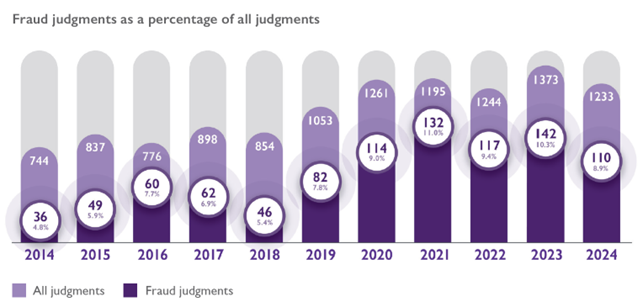

- International appeal: The English courts remain attractive to and respected by foreign users, albeit there are challenges. Since 2020 a third of claimants and a fifth of defendants have been resident overseas.

Watch the report findings here

Alex Jay and Charlie Mercer hosted a webinar with Mondaq, presenting key insights from their report. Click the image below to watch.

Press coverage

The report has since received commentary from The Times, remarking on the findings that “international parties represent a third of all claimants in England and Wales and a fifth of defendants.”

Findings from this report were first published in City AM, the article noting that “British businesses are facing an all-time high level of fraud. The only way for businesses to recover what was stolen from them is to seek legal action.”

Senior associate Charlie Mercer told City AM: “Fraud litigation remains very active in the UK and these types of claims have increased over the last decade. This would most obviously be driven by an increase in fraud in society more widely, but could also be attributed to other factors, such as parties and their advisers being increasingly sophisticated and knowledgeable about what claims may be available.”

Businesses have a critical few months ahead, as the new Failure to Prevent Fraud Offence comes into force from 1 September. Head of Insolvency and Asset Recovery Alex Jay commented: “Many [businesses] will already now have their procedures in place or will be finalising them. The market will be awaiting the first cases to emerge from this, as well as any related litigation.”

Get in touch

You can find further information regarding our expertise, experience and team on our Fraud page.