We recently partnered with Lexology to host a webinar about how to conduct internal investigations in the midst of a pandemic and beyond.

The pandemic has changed the world and how we all operate. With the acceleration of remote working, companies now have to address concerns of internal wrongdoing and regulatory breaches in a manner compliant with legal, practical and commercial expectations.

This, when combined with an uptick in corporate wrongdoing, including furlough fraud, opportunistic money laundering, illicit financing and cybercrime, means that now more than ever, corporates must know how best to conduct internal investigations that are proportionate, targeted and expedient.

In this webinar, Head of Financial Crime David Savage, Tax Director Lisa Vanderheide and Employment Partner Charlie Thompson cover:

- Do’s and don’ts when conducting internal investigations in a remote world

- An overview of key areas of exposure for businesses who have availed themselves of Covid-19 government funding, and

- How best to get ahead of the curve

The recording

Click here to watch the webinar. The webinar is free to view, but standard registration details are required.

The webinar slides can be viewed here.

Investigation planning and remote working issues

David Savage discussed investigation planning and the importance of considering the additional requirements and nuances of this in a remote world. He also talked about the importance of communicating the scope of the investigation and factoring in the additional time and steps that may be required to gather evidence remotely.

More information on conducting an investigation remotely can be found here.

Employer’s duties and considerations for employees

Charlie Thompson gave some information from the employment perspective on investigations. He discussed how to balance an employer’s duties between the employee under investigation, the complainant, witnesses and the rest of the workforce.

Investigations around the Coronavirus Job Retention Scheme

Lisa Vanderheide discussed the possible real-life examples of investigations about the Coronavirus Job Retention Scheme, or CJRS. Data shows that 10% of CJRS claims are wrong, and HMRC has already announced it will investigate claims.

More information on the steps that HMRC is taking to recover wrongly claimed government support can be found here.

Poll questions

We asked a few poll questions to our guests during the webinar.

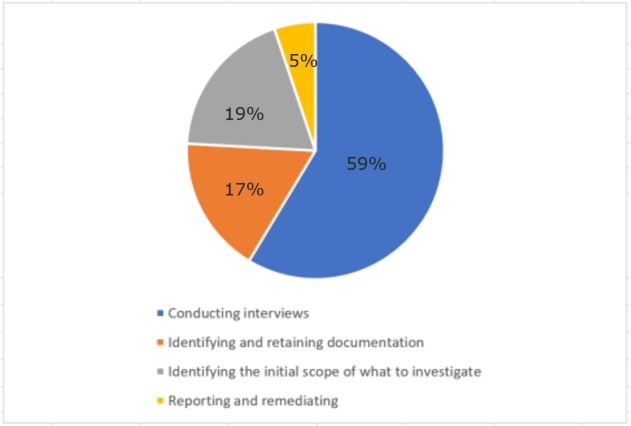

1. What do you consider to be the biggest challenge when conducting internal investigations remotely?

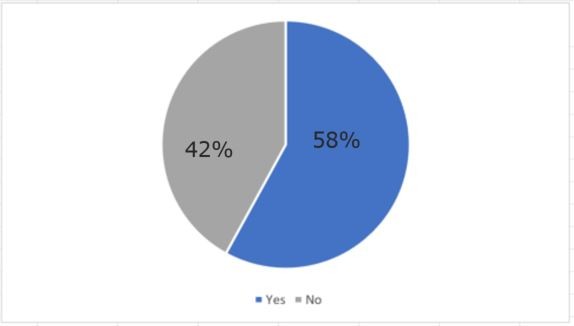

2. Do you think companies may avoid delving into their CJRS claims on the basis it is thought preferable to let sleeping dogs lie?

You can find further information regarding our expertise, experience and team on our Tax Litigation and Investigations, Financial Crime and Employment pages.

If you require assistance from our team, please contact us or request a call back from one of our lawyers by submitting this form.

Subscribe – In order to receive our news straight to your inbox, subscribe here. Our newsletters are sent no more than once a month.