Across 2023, the rate of corporate insolvencies in England and Wales fluctuated but trended significantly higher than the previous year, peaking in an especially tumultuous November. Turning from statistics to the news headlines, it was striking but perhaps not surprising to see many household name businesses forced into administration. These trends have so far continued into 2024, but it remains to be seen whether things can only get better or if the downward spiral will continue.

Alex Jay and Tim Symes of our Insolvency and Asset Recovery team comment on some of the most high-profile insolvencies to make headlines in recent weeks, and the state of the UK economy according to the latest insolvency statistics.

Insolvencies remain consistently high – but is the tide turning?

The Insolvency Service’s most recent statistics, for March 2024, revealed that the total number of all types of company insolvencies was 1,815. This was 17% lower than both the 2,177 registered in February 2024, and 2,193 in March 2023.

While on face value this could point towards the landscape becoming more stable, a further review of month-by-month insolvency figures and the overall direction of travel suggests it may be premature to declare that the tide is turning.

Tim comments: “The overall picture, looking at March’s figures, is that corporate insolvencies remain at a steady and high rate. There is a noticeable increase in creditor forced (compulsory) liquidations, which have risen by 70% since December last year. However, they will need to continue to rise a lot more to reach the dizzy heights of November when they soared to 359, and so the picture overall should not be overstated.

“Over 90% of company insolvencies are said to be sub-£1m turnover businesses, so the economic impact of these failures will be felt more at the micro than macro level. Whether these businesses are canaries in the coalmine for worse to come, or the last of the much talked about ‘zombie companies’, will only become apparent in the coming months.”

Public services and high streets under pressure

The threat of Thames Water’s potential collapse has loomed large over 2024 so far. With news emerging that shareholders were refusing to inject further new funds, and many suspecting that the taxpayer will pick up the bill for rescuing the utility, Thames Water will likely continue to make headlines for the rest of the year.

Alex comments: “If shareholders don’t inject further funds, then expensive borrowing or refinancing may be required if Thames Water is going to survive. These are not new issues for Thames Water however, and the notion that an increase in water bills should be allowed in order that the company can continue to pay dividends to shareholders is going to be deeply unattractive in the current economic climate.”

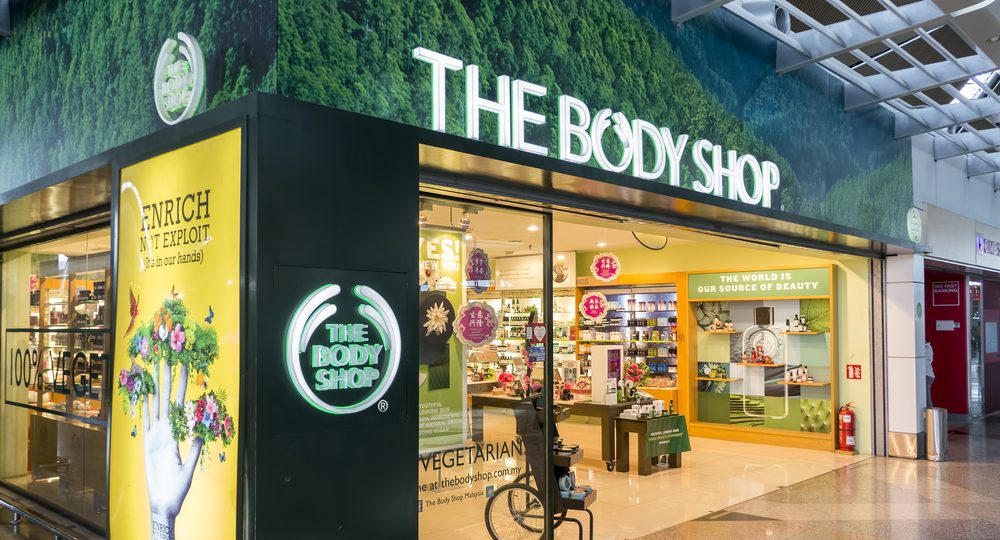

Utilities aside, perhaps the most visible indicator of the ailing economy for the general public is the steady decline of the high street. Household name brands including Ted Baker and The Body Shop have joined the ranks of the many businesses forced into administration.

Tim comments: “The slow death of the high street serves no one. Quite apart from the retailers’ demise, landlords can’t find tenants and are forced to take lower rents, and the tenants they do get may not help attract high quality neighbours, making the high street as a place to visit even less attractive. And so it goes on.

“Whether the answer lies in slashing business rates, hoping discretionary spending improves, seeing a significant fall in interest rates, or something else, we are certain to see more high street retail victims for some time to come through sheer decimation of footfall due to shopping habits increasingly moving online.”

The tangled web of administration

Insolvencies are inevitably messy, but several recent examples have demonstrated how complicated these processes are.

Few messy insolvencies have been as closely trailed in the media as that of financial services firm Greensill. In the latest development, administrators have threatened to attempt to seize up to £472m in unpaid funds from steel magnate Sanjeev Gupta’s GFG Alliance. A report given by Greensill’s administrators Grant Thornton said they would “consider recovery options that are available” under GFG’s security and guarantees.

Tim spoke to City AM about the report: “Like any security, a guarantee to pay another company’s debts is only as good as the giver’s ability to actually pay it. The GFG group of companies is complex and opaque, so it remains to be seen whether the companies that have granted the guarantees are in fact the ones with sufficient value to meet any payment demands from administrators.”

A group of businesses part owned by the Sir Terry Leahy-backed Nova Group Holdings has been placed into insolvency despite having received £9 million from the government’s Future Fund. Requiring equivalent private investment, payment from the Future Fund has a 100% “redemption premium” attached, the theory being that taxpayer money will therefore be returned twice over. Various other rules are attached to the scheme, but an investigation by The Times found that “about £8 million of proceeds from the Future Fund loans had made its way back to Nova Group in the form of a loan from a subsidiary.”

Alex comments: “The administrators will have extensive powers to investigate a breach of the Future Fund scheme rules and identify who was responsible for it – including the directors who presided over the group. If 90% of the Future Fund monies were paid to Nova Group as reported then the key questions will be (a) were the start-ups entitled to the funds in the first place and, (b) what value did they receive from Nova that justified making the payments to it.”

Placing a business into administration is rarely desirable for any of the parties involved, but in some instances, parties will publicly dispute whether it is the right call. In one example, MatchesFashion’s former CEO Nick Beighton suggested shortly after his recent departure that new owner Frasers Group’s decision to put the luxury retailer into administration three months after acquiring it was “unnecessary”.

Tim comments: “A decision by a secured lender to put a company into administration is grave, and requires it to weigh up complex competing factors and make best assessments of the business’ prospects of trading out of insolvency. It follows that when such judgment calls are made and the company is put into a regime as serious as administration, a volley of dissenting voices can be expected to follow.”

You can find further information regarding our expertise, experience and team on our Insolvency and Asset Recovery page.

If you require assistance from our team, please contact us or alternatively request a call back from one of our lawyers by submitting this form.