The construction sector continues to be a focus area for legal and regulatory changes. In this chapter, partner Chloe Derrick and associates Jesal Parekh and Zara Okereafor explain how disputes remain firmly at the forefront and show no signs of slowing down.

The Building Safety Act 2022 (BSA) has altered the landscape, and the changes introduced have given rise to a significant number of fire and building safety disputes. As discussed further in this chapter, the Supreme Court has now confirmed that developers have a right under the Defective Premises Act 1972 (DPA) to recover the costs of remediating buildings from relevant parties in the supply chain, and can benefit from the extended limitation periods arising under section 135 of the BSA.

Against a government mantra of swifter fire safety remediation and a 2029 deadline for the removal of unsafe cladding, the new duties and liabilities introduced under the BSA continue to give rise to significant financial orders against construction businesses, including on a non‑fault basis. Additionally, the Remediation Acceleration Plan (RAP) and the proposed powers sought under the Remediation Bill give rise to potentially severe penalties for any failures to remediate buildings within the government’s timescales.

Such a significant shift in duties, liabilities and remedies has a corresponding impact on the potential for coverage disputes, particularly in areas of uncharted territory.

Cladding and fire safety claims

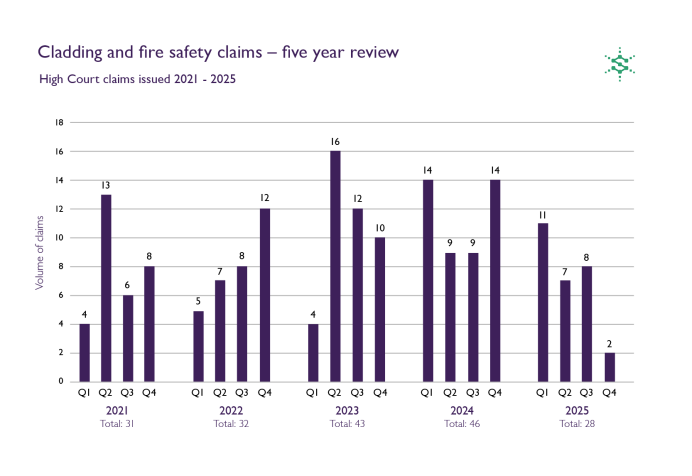

Analysis from Solomonic confirms that the number of cladding and fire safety claims issued in the High Court has decreased for the first time in five years.

In conjunction with Solomonic, we have analysed the number of High Court claims issued over the last five years that relate to cladding and fire safety. The Solomonic dataset is based on claims that contain any of the following topics: Grenfell, cladding, fire safety issues, the Defective Premises Act, the Building Safety Act or the Fire Safety Act.

Since 2021, 257 such claims have been issued, with claims peaking in 2023 and 2024, no doubt due to the introduction of the BSA.

For 2025, while substantial disputes are ongoing, there has been a significant reduction in the number of High Court claims issued. In circumstances where thousands of buildings still require remediation, that decrease may be the result of the BSA leading parties to seek new remedies in the Property Chamber of the First tier Tribunal, which are not available in traditional litigation. As we anticipated last year, it is possible that we may see an influx of claims returning to the High Court for determination when disputes arise as to which party should ultimately bear the costs of any Remediation Orders made.

Equally, the reduction in claims issued over the past 12 months might reflect the Supreme Court’s judgment in URS v BDW. Now that construction supply chain professionals face long tail exposures under the DPA, developers may be choosing to carry out remediation works first, with recovery actions pursued at a later date. If that is the case, we may see a wave of professional indemnity claims issued by building owners and developers against their third party supply chain contractors in due course.

Construction: overview of the market

Laurence Paddock, Associate Director – Financial Lines Group, and Jamie Russell, Associate Director, Financial Lines Group Claims, both from Howden, provide an overview of the construction market from a broker’s perspective. They say:

“The construction professional indemnity insurance (PII) market has continued to soften over the past 12 months. The increase in new insurer entrants to the market has created significant competition, both on renewal lines and new business. Well-run firms, without systemic claims issues and with robust, evidenced risk management procedures, are likely to see significant benefits from this, both in terms of premium and policy coverage.”

Other topics covered include:

• Key legislative and regulatory developments in 2025

• The Building Safety Act 2022 (BSA)

• URS Corporation v BDW Trading

• What does this wider liability for remediating fire safety defects mean for professional indemnity insurance?

• Remediation Orders (section 123)

• Remediation Contribution Orders (section 124)

• Building Liability Orders (section 130-132)

• Damage and aggregation clarity in Construction All Risks insurance.

Read more

To read the full chapter and additional commentary on key developments and trends across various commercial lines, click the button below.